Resource Dependence

Abundance or Scarcity of Needed Financial Resources

In the preceding posts, we have described several ways in which organizations adapt to the lack of information and to the uncertainty caused by environmental dynamism and complexityOpens in new window.

We turn now to the third characteristic of the organization–environment relationship that affects organizations, which is the abundance or scarcity of needed financial resources.

A first response for many organizations faced with declining financial resources is to lay off employees and cut investments. In recent years, large oil companies such as Royal Dutch ShellOpens in new window, BPOpens in new window, and ChevronOpens in new window have significantly cut costs for finding and developing oil deposits due to declining crude oil prices.

U.S. shale oil drillers have adapted to lower crude prices by pushing for reduced rates from suppliers of rigs, pipes, and other equipment and services, enabling the drillers to cut production costs by as much as 40 percent.

Companies also strive to acquire control over financial resources to minimize their dependence on other organizations. The environment is the source of scarce financial resources essential to organizational survival. Research in this area is called the resource-dependence perspective.

Resource dependence means that organizations depend on the environment but strive to acquire control over resources to minimize their dependence.

Organizations are vulnerable if vital financial resources are controlled by other organizations, so they try to be as independent as possible. Organizations do not want to become too vulnerable to other organizations because of negative effects on performance.

Although companies like to minimize their dependence, when costs and risks are high, they also team up to share scarce resources and be more competitive on a global basis.

Formal relationships with other organizations present a dilemma to managers. Organizations seek to reduce vulnerability with respect to resources by developing links with other organizations, but they also like to maximize their own autonomy and independence.

Organizational linkagesOpens in new window require coordination, and they reduce the freedom of each organization to make decisions without concern for the needs and goals of other organizations.

Interorganizational relationshipsOpens in new window thus represent a trade-off between resources and autonomy. To maintain autonomy, organizations that already have abundant financial resources will tend not to establish new linkages.

Organizations that need resources will give up independence to acquire those resources. For example, DHLOpens in new window, the express delivery unit of Germany’s Deutsche Post AG, lost billions of dollars trying to take over the U.S. package delivery market and eventually entered into a partnership with UPSOpens in new window to have that company handle DHL parcels in the United States.

The two organizations continue to compete in overseas markets. In the face of $3 billion in losses, difficulty building a local management team in the United States, and maintenance problems at U.S. package handling facilities, Deutsche Post’s CEO Frank Appel called the partnership with UPS “a pragmatic and realistic strategy” for his company’s U.S. operations.

Influencing Financial Resources

In response to the need for resources, organizations try to maintain a balance between depending on other organizations and preserving their own independence.

Organizations maintain this balance through attempts to modify, manipulate, or control elements of the external environment (such as other organizations, government regulators) to meet their needs.

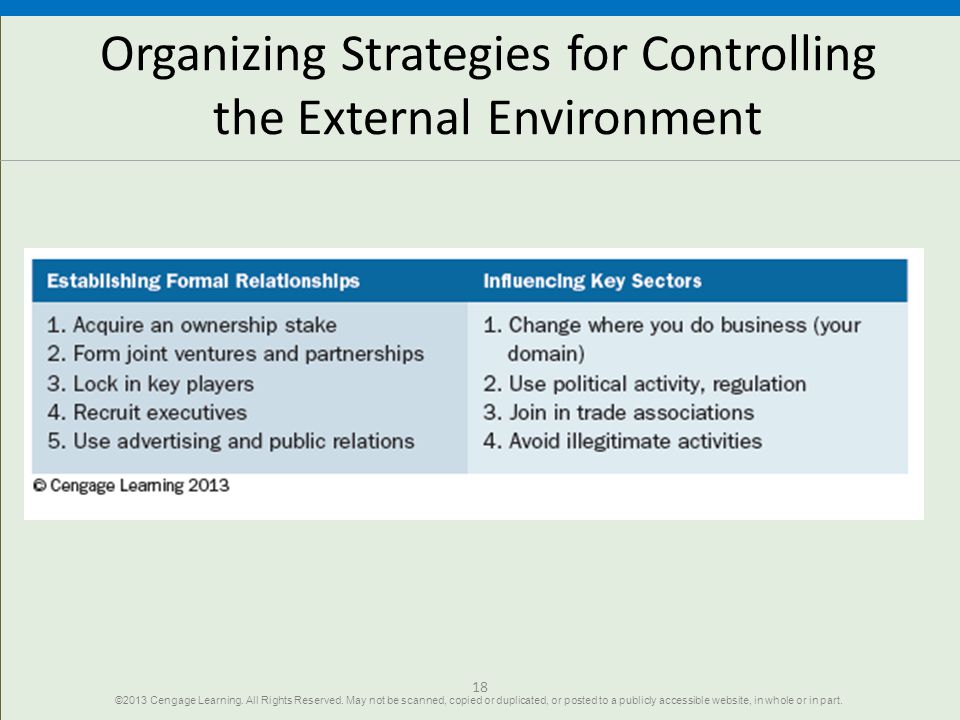

To survive, the focal organization often tries to reach out and change or control its environment. Two strategies can be adopted to influence resources in the external environment:

- establish favorable relationships with other organizations and

- shape the organization’s environment.

Techniques to accomplish each of these strategies are summarized in Figure X-8. As a general rule, when organizations sense that valued resources are scarce, they will use the strategies in Figure X-8 rather than go it alone.

Figure X-8 Organizing Strategies for Controlling the External Environment | Credit — Slideplayer Opens in new window

Figure X-8 Organizing Strategies for Controlling the External Environment | Credit — Slideplayer Opens in new window

|

Notice how dissimilar these strategies are from the responses to environmental dynamism and complexity described in Figure X-7Opens in new window. The dissimilarity reflects the difference between responding to the need for resources and responding to the need for information.

Establishing Formal Relationships

Building formal relationships includes techniques such as acquiring ownerships, establishing joint ventures and partnerships, developing connections with important people in the environment, recruiting key people, and using advertising and public relations.

- Acquiring an Ownership Stake

Companies use various forms of ownership to reduce uncertainty in an area important to the acquiring company. For example, a firm might buy a part of or a controlling interest in another company, giving it access to technology, product, or other resources it doesn’t currently have.

A greater degree of ownership and control is obtained through acquisition or merger.

- An acquisition involves the purchase of one organization by another so that the buyer assumes control, such as when Target bought grocery delivery company ShiptOpens in new window, Google bought YouTubeOpens in new window, eBay bought PayPalOpens in new window, and Walmart purchased the online clothing company ModClothOpens in new window.

- A merger is the unification of two or more organizations into a single unit. Sirius Satellite Radio and XM Satellite Radio Holdings mergedOpens in new window to become Sirius XM RadioOpens in new window.

The merger enabled the companies to combine resources and share risks to be more competitive against digital music providers and other emerging types of music distribution. In the past few years, there has been a huge wave of acquisition and merger activity in the telecommunications and advertising they face.

PublicisOpens in new window and OmnicomOpens in new window have been acquiring smaller companies that can help the large firms adapt to the new world of digital advertising.

| IN PRACTICE | Publicis and Omnicom |

|---|

| The marketing environment has become much more personalized in recent years, with companies wanting to send targeted ads directly to consumers’ social media pages and smart phones. Advertising agencies are under pressure like never before. A few years ago, the giant advertising firms Omnicom and Publicis tried to negotiate a “merger of equals” to better compete in a rapidly shifting environment in which companies such as Google and Microsoft worked directly with companies to create targeted ad campaigns. Within a year, they announced that the proposed $35 billion merger was off. Instead, both firms started buying up smaller companies that would bring digital technology experts on board. Publicis, for example, bought Sapient, an information-technology consulting firm, and digital marketing specialists Digitas Inc and Razorfish. However, getting digital technology people and traditional creative types to work together has been a challenge, reflecting the need for greater integration, as described earlier. Creative people used to call the shots, but today advertising and marketing is “big data” business. That was brought home to Publicis when McDonald’s wanted a new broad marketing plan that required analyzing massive amounts of data to produce online ads quickly and target specific messages to very narrow audiences. When publicis got a team of copywriters, art directors, and computer engineers together to talk about the campaign, team members couldn’t even agree on the meaning of basic terms such as “data” and “content,” one participant said. Publicis lost the account to rival Omnicom, which had worked closely with Facebook and Google to assemble the right mix of creative talent and data experts. |

- Form Joint Ventures and Patnerships

When there is a high level of complementarity between the business lines, geographical positions, or skills of two companies, the firms often go the route of a strategic alliance rather than ownership through merger or acquisition. Such alliances are formed through contracts and joint ventures.

Contracts and joint ventures reduce uncertainty through a legal and binding relationship with another firm.

Contracts come in the form of:

- License agreements which involve the purchase of the right to use an asset (such as a new technology) for a specific time.

- Supplier arrangements which is the contract for the sale of one firm’s output to another.

Contracts can provide long-term security by tying customers and suppliers to specific amounts and prices. For example, the Italian fashion house VersaceOpens in new window promulgated a deal to license its primary asset—its name—for a line of designer eyeglasses.

Joint ventures result in the creation of a new organization that is formally independent of the parents, although the parents will have some control.

Madrid-based tech start-up FONOpens in new window formed a joint venture with British phone carrier BTOpens in new window to install FON wi-fi technology in the modems of nearly 2 million BT customers.

Office DepotOpens in new window and Reliance Retail LimitedOpens in new window, a division of India’s largest private-sector employer, entered into a joint venture to provide office products and services to business customers in India.

Food and agricultural corporation Cargill Inc.Opens in new window has numerous joint ventures around the world, such as the one with Spanish cooperative Hojiblanca to source, trade, and supply customers worldwide with private label and bulk olive oils.

As evidenced by these short examples, many joint ventures are undertaken to share risks when companies are doing business in other countries or on a global scale.

- Lock in Key Players

Cooptation occurs when leaders from important sectors in the environment are made part of an organization.

It takes place, for example, when influential customers or suppliers are appointed to the board of directors, such as when the senior executive of a bank sits on the board of a manufacturing company.

As a board member, the banker may become psychologically coopted into the interests of the manufacturing firm.

An interlocking directorate is a formal linkage that occurs when a member of the board of directors of one company sits on the board of directors of another company.

The individual is a communication link between companies and can influence policies and decisions.

When one individual is the link between two companies, this is typically referred to as a “direct interlock”. An “indirect interlock” occurs when a director of company A and a director of company B are both directors of company C.

They have access to one another but do not have direct influence over their respective companies.

Research shows that, as a firm’s financial fortunes decline, direct interlocks with financial institutions increase. Financial uncertainty facing an industry also has been associated with greater indirect interlocks between competing companies.

Important business or community leaders also can be appointed to other organizational committees or task forces. By serving on committees or advisory panels, these influential people learn about the needs of the company and are more likely to consider the company’s interests in their decision making.

Today, many companies face uncertainty from environmental pressure groups, so organizations are trying to bring in leaders from this sector, such as when DuPont appointed environmentalists to its biotechnology advisory panel.

- Recruit Executives

Transferring or exchanging executives also offers a method of establishing favorable linkages with external organizations. For example, the aerospace industry often hires retired generals and executives from the Department of Defense.

These generals have personal friends in the department, so the aerospace companies obtain better information about technical specifications, prices, and dates for new weapons systems. They can learn the needs of the defense department and are able to present their case for defense contracts in a more effective way.

Companies without personal contracts find it nearly impossible to get a defense contract. Having channels of influence and communication between organizations reduces financial uncertainty and dependence for an organization.

- Get Your Side of the Story Out

A traditional way of establishing favorable relationships is through advertising. Organizations spend large amounts of money to influence the tastes and opinions of consumers.

Advertising is especially important in highly competitive industries and in industries that experience variable demand.

For example, since the U.S. Food and Drug AdministrationOpens in new window loosened regulations on the advertising of prescription drugs in the United States, spending by the major pharmaceutical companies has zoomed.

A recent report indicates that advertising of prescription drugs directly to consumers went from $1.3 billion in 1997 to $6 billion in 2016.

Public relations is similar to advertising, except that stories often are free and aimed at public opinion. Public relations people cast an organization in a favorable light in speeches, on websites, in press reports, and on television. Public relations attempt to shape the company’s image in the minds of customers, suppliers, government officials, and the broader public.

Google is a master at shaping its image through donations, fellowship programs, and at conferences that establish a network of ties to advocacy organizations, public intellectuals, and academic institutions that often take Google’s side in public debates and national policy issues.

By encouraging and sometimes supporting groups that hold viewpoints similar to its own, Google has an ongoing widespread PR campaign that one reporter referred to as subtle acts of persuasion.

Blogging, tweeting, and social networking have become important components of public relations activities for many companies today.

Influencing Key Sectors

In addition to establishing favorable linkages, organizations often try to change the environment. There are four techniques for influencing or changing a firm’s environment.

- Change Where You Do Business

Earlier we talked about the organization’s domainOpens in new window and the 11 sectors of the environment. An organization’s domain is not fixed.

Managers make decisions about which business to be in; markets to enter; and the suppliers, banks, employees, and location to use; and the domain can be changed, if necessary, to keep the organization competitive.

An organization can seek new environmental relationships and drop old ones. Walmart, which long focused on its big box retail stores, now has a strong e-commerce business, while Amazon is trying to build a physical presence across the nation.

| IN PRACTICE | Amazon and Walmart |

|---|

| Walmart is still playing catch-up to Amazon online, but the country’s largest brick-and-mortar retailer also now has a thriving online business. In addition to its regular business, Walmart has recently been buying up small, unique online retailers such as ModCloth, ShoeBuy, and Moosejaw that can help the company appeal to more customers. Walmart plans to let the companies operate as separate entities. At the same time, Amazon, the giant of e-commerce, is building convenience stores, ware-houses, pickup locations, and even grocery stores across the country that will invade Walmart’s turf. Amazon has decided it wants to control all shopping, not just online shopping. To remain competitive, Walmart had to learn the rules of the technology business from the ground up. It acquired a number of companies that could build tools to crunch data, create mobile apps, and speed up websites. Managers at the two giants are now shifting their domains so that Walmart is becoming more technology oriented and Amazon is competing more in physical space. Both companies believe the future is a combination of stores and online. |

Walmart managers knew they needed to alter the domain to be more competitive against Amazon as shopping habits continue to shift more toward online. Managers have many reasons for altering an organization’s domain. They may try to find a domain where there is little competition, no government regulation, abundant suppliers, affluent customers, and barriers to keep competitors out.

Acquisition and divestment are two techniques for altering the domain. For example, Google acquired YouTube to expand its domain beyond search, and Facebook paid $16 billion for WhatsApp, a text-messaging application with 450 million users. An example of divestment was when Google sold the Motorola Mobility smartphone unit to Lenovo for $2.9 billion to get out of the business of manufacturing phones.

- Get Political

Political activity includes techniques to influence government legislation and regulation. Political strategy can be used to erect regulatory barriers against new competitors or to squash unfavorable legislation.

Corporations also try to influence the appointment to agencies of people who are sympathetic to their needs. As an example of political activity, the American Hotel and Lodging AssociationOpens in new window, which counts some of the largest hotel chains among its members, has quietly but forcefully lobbied local, state, and federal officials to rein in AirbnbOpens in new window.

The group has been able to get bills signed to impose steep fines on Airbnb hosts who break local housing rules, for instance. Airbnb is a significant threat to the hotel industry, so its trade group has implemented a long-term “multipronged, national campaign” to fight back.

Many CEOs believe they should participate directly in lobbying. CEOs have easier access than lobbyists and can be especially effective when they do the politicking. Political activity is so important that “informal lobbyist” is an unwritten part of almost any CEO’s job description.

- Unite with Others

Much of the work to influence the external environment is accomplished jointly with other organizations that have similar interests. For example, most large pharmaceutical companies belong to Pharmaceutical Research and Manufacturers of AmericaOpens in new window.

Manufacturing companies are part of the National Association of ManufacturersOpens in new window, and retailers join the Retail Industry Leaders AssociationOpens in new window. The American Petroleum InstituteOpens in new window is the leading trade group for oil and gas companies.

By pooling resources, these organizations can pay people to carry out activities such as lobbying legislators, influencing new regulations, developing public relations campaigns, and making contributions.

PrimericaOpens in new window, based in a suburb of Atlanta, is using the resources and influence of the American Council of Life InsurersOpens in new window to push for changes in state licensing exams, which the company believes put minorities at a disadvantage.

Primerica, unlike most large insurance companies, focuses on selling basic term life insurance and depends almost exclusively on middle-income consumers rather than selling pricier policies. Company managers say the way the test questions are phrased limits their ability to expand their corps of minority agents that could better serve minority communities.

- Don’t Fall into Illegitimate Activities

Illegitimate activities represent the final technique companies sometimes use to control their environmental domain, but this technique typically backfires. Conditions such as low profits, pressure from senior managers, or scarce environmental resources may lead managers to adopt behaviors not considered legitimate.

One study found that companies in industries with low demand, shortages, and strikes were more likely to be convinced for illegal activities, suggesting that illegal acts are an attempt to cope with resource scarcity.

Some profit organizations have been found to use illegitimate or illegal actions to bolster their visibility and reputation as they compete with other organizations for scarce grants and donations, for example.

Bribery is one of the most frequent types of illegitimate activity, particularly in companies operating globally. Energy companies face tremendous uncertainty, for example, and need foreign governments to approve giant investments and authorize risky projects.

Under pressure to win contracts in Nigeria, Albert “Jack” Stanley, a former executive at KBR (then a division of Halliburton Company), admits he orchestrated a total of about $182 million in bribes to get Nigerian officials to approve the construction of a liquefied natural gas plant in that country. Stanley was sentenced to 30 months in prison and a hefty fine after pleading guiltyOpens in new window.

Other types of illegitimate activities include payoffs to foreign governments, illegal political contributions, promotional gifts, and price-fixing. For nearly a decade, executives from Procter & Gamble (P&G), Colgate-Palmolive, Unilever, and Henkel AG secretly met in restaurants around Paris to allegedly fix the price of laundry detergent in France.

The managers used fake names and discussed elaborate and complex pricing mechanisms in meetings that sometimes lasted as long as four hours. The scheme went on for years until members had a disagreement over price increases and promotions and one member handed over a 282-page report to French anti-trust authorities. The companies involved were eventually fined a total of €361 ($484 million).

| Remember This! |

|---|

|

The series:

- Organizational EnvironmentOpens in new window

- Environmental UncertaintyOpens in new window

- Adapting to Complexity and DynamismOpens in new window

- Differentiation and IntegrationOpens in new window

- Planning, Forecasting, and ResponsivenessOpens in new window

- Abundance/Scarcity of Needed Financial ResourcesOpens in new window

- Research data for this work have been adapted from the manual:

- Organization Theory & Design By Richard L. Daft