Incremental versus Zero-Base Budgets

Most organizations construct next year’s budget by starting with the current year’s budget, then adjusting each line item for expected price and volume changes. Each manager submits a budget for the next year by making incremental changes in each line item. For example, the line item in next year’s budget for purchases is calculated by increasing last year’s purchases for inflation and including any incremental purchases due to volume changes and new programs. Only detailed explanations to justify the increments are submitted or reviewed. These incremental budgets are reviewed and changed at higher levels in the organization, but usually only the incremental changes are examined in detail. The base/core budget (i.e., last year’s base budget) is taken as given.

Under zero-base budgeting (ZBB), senior management mandates that each line item in total must be justified and reviewed each year. Each line item is reset to zero each year. Departments must defend the entire expenditure yearly, not just the changes. In a zero-base budget review, the following questions are generally asked: should this activity be provided? What will happen if the activity is eliminated? At what quality/quantity level should the activity the activity be provided? Can the activity be provided in some alternative way, such as outsourcing the activity to another organization? How much are other, similar companies spending on the activity (benchmarking)?

In principle, ZBB motivates managers to maximize firm value by identifying and eliminating those expenditures whose total costs exceed total benefits. Under incremental budgeting, in which incremental changes are added to the base budget, incremental expenditures are deleted when their costs exceed their incremental benefits. However, inefficient base budgets often continues to exist.

In practice, ZBB is used infrequently, ZBB is supposed to overcome traditional, incremental budgeting, but it often deteriorates into exactly that. Each year under ZBB, the same justifications as those used in the previous year are typically submitted and adjusted for incremental changes. Since the volume of detailed reports rising up the organization is substantially larger under ZBB than under incremental budgeting, higher-level managers tend to focus on the changes from last year anyway. The focus on budgetary changes is especially true, if managers have been with the organization for a number of years and already know the ‘base’-level budgets.

ZBB is most useful and common when new top-level managers come from outside the firm. The new managers do not have the specialized knowledge incorporated in the base budgets. New outside managers also bring changes in strategy. Prior budgets are no longer as relevant with each line item requiring justification in light of these changing goals and strategies. However, ZBB is substantially more costly to conduct and is unlikely to continue once management has gained knowledge of operations and the budgets have encompassed the new goals.

Normally, accountants have the responsibility for presenting management’s budgeting goals in financial terms. In this role:

- They translate management’s plans and communicate the budget to employees throughout the company.

- They prepare periodic budget reports that provide the basis for measuring performance and comparing actual results with planned objectives.

The budget itself, and the administration of the budget, however, are entirely management responsibilities.

The Benefits of Budgeting

The primary benefits of budgeting are:

- It requires all levels of management to “plan ahead and to formalize goals on a recurring basis.

- It provides “definite objectives for evaluating performance at each level of responsibility.

- It creates an “early warning system for potential problems so that management can make changes before things get out of hand.

- It facilitates the “coordination of activities within the business. It does this by correlating the goals of each segment with overall company objectives. Thus, the company can integrate production and sales promotion with expected sales.

- It results in greater “management awareness of the entity’s overall operations and the impact on operations of external factors, such as economic trends.

- It “motivates personnel throughout the organization to meet planned objectives.

A budget is an aid to management; it is not a substitute for management. A budget cannot operate or enforce itself. Companies can realize the benefits of budgeting only when managers carefully administer budgets.

Essentials of Effective Budgeting

Effective budgeting depends on a “sound organizational structure. In such a structure, authority and responsibility for all phases of operations are clearly defined.

Budgets based on research and analysis should result in realistic goals that will contribute to the growth and profitability of a company. And, the effectiveness of a budget program is directly related to its acceptance by all levels of management.

Once adopted, the budget is an important tool for evaluating performance. Managers should systematically and periodically review variations between actual and expected results to determine their cause(s). However, individuals should not be held responsible for variations that are beyond their control.

Length of the Budget Period

The budget period is not necessarily one year in length. A budget may be prepared for any period of time. Various factors influence the length of the budget period. These factors include:

- the type of budget,

- the nature of the organization,

- the need for periodic appraisal, and

- prevailing business conditions. For example, cash may be budgeted monthly, whereas a plant expansion budget may cover a 10-year period.

The budget period should be long enough to provide an attainable goal under normal business conditions. Ideally, the time period should minimize the impact of seasonal or cyclical fluctuations. On the other hand, the budget period should not be so long that reliable estimates are impossible.

The most common budget period is one year. The annual budget, in turn, is often supplemented by monthly and quarterly budgets.

Many companies use continuous 12-month budgets. The budgets drop the month just ended and add a future month. One advantage of continuous budgeting is that it keeps management planning a full year ahead.

The Master Budget

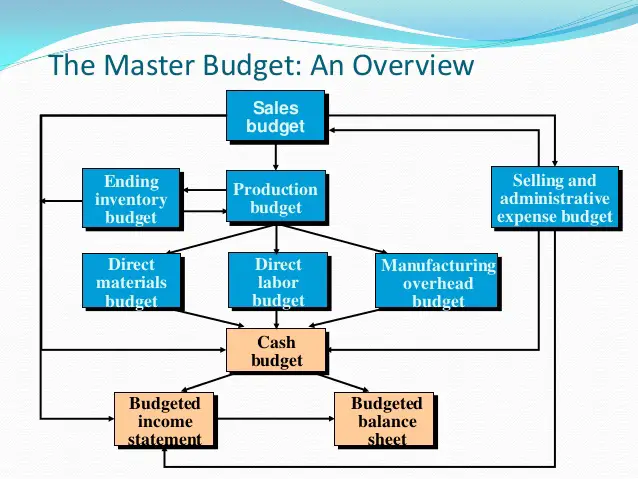

The term budget is actually a shorthand term to describe a variety of budget documents. All of these documents are combined into a master budget.

The master budget is a set of interrelated budgets that constitutes a plan of action for a specific time period.

The master budget contains two classes of budgets:

- Operating budgets are the individual budgets that result in the preparation of the budgeted income statement. These budgets establish goals for the company’s sales and production personnel.

- Financial budgets, in contrast, are the capital expenditure budget, the cash budget, and the budgeted sheet.

These budgets focus primarily on the cash resources needed to fund expected operations and planned capital expenditures. Figure X-1 shows the individual budgets included in a master budget, and the sequence in which they are prepared.

Figure X-1. Master Budget. Credit: SlideShare.

Figure X-1. Master Budget. Credit: SlideShare.

The organization first develops the operating budgets, beginning with the sales budget. Then it prepares the financial budgets. These budgets are important to discuss, however, they are beyond the scope of this literature.

You Might Also Like:

- Research data for this work have been adapted from the manual:

- Managerial Accounting: Tools for Business Decision Making By Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso