Line-Item Budgets

Line-item budgets refer to budgets that authorize the manager to spend only up to the specified amount on each line item. For example, consider Table XI.

| Line-Item Budget Example | |

|---|---|

| Line Item | Amount |

| Salaries | $185,000 |

| Office supplies | 12,000 |

| Office equipment | 3,000 |

| Postage | 1,900 |

| Maintenance | 350 |

| Utilities | 1,200 |

| Rent | 900 |

| Total | $204,350 |

In this budget, the manager is authorized to spend $12,000 on office supplies for the year. If the supplies can be purchased for $11,000, the manager with a line-item budget is prohibited from spending the $1,000 savings on any other category (such as additional office equipment). The manager cannot spend savings from one line item on another line item without prior approval; therefore, the manager has less incentive to look for savings. Moreover, if next year’s line item is reduced by the amount of the savings, managers have even less incentive to search for savings.

Line-item budgets impose more control on managers. Managers responsible for line-item budgets cannot reduce spending on one item and divert the savings to items that enhance their own welfare. By maintaining tighter control over how much is spent on particular items, the organization reduces the possibility of management action that is inconsistent with organizational goals. Line-item budgets, however, come at a cost. They reduce management incentives to search for cost savings and also reduce the organization’s flexibility to adapt quickly to changing market conditions.

Line-item budgets are quite prevalent in government organizations such as local councils and police authorities. They are also used in some corporations, but with fewer restrictions. Line-item budgets provide an extreme form of control. The manager does not have the responsibility to substitute resources among line items as circumstances change. Such changes during the year require special approval from a higher level in the organization, such as the local council.

Line-item budgets illustrate how the budgeting system partitions responsibilities, thereby controlling behavior. In particular, a manager given the responsibility to spend up to $30,000 on office equipment does not have the responsibility to substitute office equipment for postage.

Normally, accountants have the responsibility for presenting management’s budgeting goals in financial terms. In this role:

- They translate management’s plans and communicate the budget to employees throughout the company.

- They prepare periodic budget reports that provide the basis for measuring performance and comparing actual results with planned objectives.

The budget itself, and the administration of the budget, however, are entirely management responsibilities.

The Benefits of Budgeting

The primary benefits of budgeting are:

- It requires all levels of management to “plan ahead and to formalize goals on a recurring basis.

- It provides “definite objectives for evaluating performance at each level of responsibility.

- It creates an “early warning system for potential problems so that management can make changes before things get out of hand.

- It facilitates the “coordination of activities within the business. It does this by correlating the goals of each segment with overall company objectives. Thus, the company can integrate production and sales promotion with expected sales.

- It results in greater “management awareness of the entity’s overall operations and the impact on operations of external factors, such as economic trends.

- It “motivates personnel throughout the organization to meet planned objectives.

A budget is an aid to management; it is not a substitute for management. A budget cannot operate or enforce itself. Companies can realize the benefits of budgeting only when managers carefully administer budgets.

Essentials of Effective Budgeting

Effective budgeting depends on a “sound organizational structure. In such a structure, authority and responsibility for all phases of operations are clearly defined.

Budgets based on research and analysis should result in realistic goals that will contribute to the growth and profitability of a company. And, the effectiveness of a budget program is directly related to its acceptance by all levels of management.

Once adopted, the budget is an important tool for evaluating performance. Managers should systematically and periodically review variations between actual and expected results to determine their cause(s). However, individuals should not be held responsible for variations that are beyond their control.

Length of the Budget Period

The budget period is not necessarily one year in length. A budget may be prepared for any period of time. Various factors influence the length of the budget period. These factors include:

- the type of budget,

- the nature of the organization,

- the need for periodic appraisal, and

- prevailing business conditions. For example, cash may be budgeted monthly, whereas a plant expansion budget may cover a 10-year period.

The budget period should be long enough to provide an attainable goal under normal business conditions. Ideally, the time period should minimize the impact of seasonal or cyclical fluctuations. On the other hand, the budget period should not be so long that reliable estimates are impossible.

The most common budget period is one year. The annual budget, in turn, is often supplemented by monthly and quarterly budgets.

Many companies use continuous 12-month budgets. The budgets drop the month just ended and add a future month. One advantage of continuous budgeting is that it keeps management planning a full year ahead.

The Master Budget

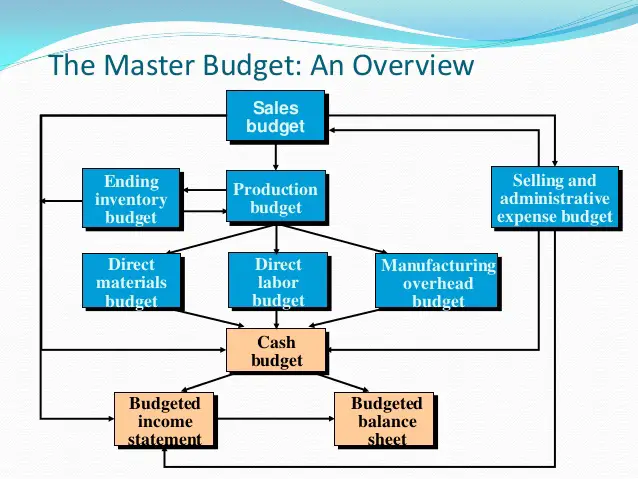

The term budget is actually a shorthand term to describe a variety of budget documents. All of these documents are combined into a master budget.

The master budget is a set of interrelated budgets that constitutes a plan of action for a specific time period.

The master budget contains two classes of budgets:

- Operating budgets are the individual budgets that result in the preparation of the budgeted income statement. These budgets establish goals for the company’s sales and production personnel.

- Financial budgets, in contrast, are the capital expenditure budget, the cash budget, and the budgeted sheet.

These budgets focus primarily on the cash resources needed to fund expected operations and planned capital expenditures. Figure X-1 shows the individual budgets included in a master budget, and the sequence in which they are prepared.

Figure X-1. Master Budget. Credit: SlideShare.

Figure X-1. Master Budget. Credit: SlideShare.

The organization first develops the operating budgets, beginning with the sales budget. Then it prepares the financial budgets. These budgets are important to discuss, however, they are beyond the scope of this literature.

You Might Also Like:

- Research data for this work have been adapted from the manual:

- Managerial Accounting: Tools for Business Decision Making By Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso